King Dollar

All About the Benjamins

Reserve Currency Criteria

For the last two decades or so people have been predicting the end of the U.S. Dollar (USD) as the world's reserve currency. Reserve currencies are held by governments and financial institutions to facilitate global trade, and balance of payments (BOP) crises. One day it will happen, but global reserve currencies through history are not fleeting phenomena. Prior to the USD taking that throne, the British Pound held the crown for almost two centuries. Before that, the Spanish Silver Dollar was dominant between the 15th to the 18th centuries.

The status of a global reserve currency is typically determined by a combination of economic, political, and financial factors that reflect the dominance and stability of the issuing nation. Economic size and strength are at the top of the list, as the more global activity is conducted in a currency, the greater the need to hold that currency worldwide. Deep and broad financial markets are required as well, since USD being held needs to be invested somewhere, and certain entities need to hedge risk.

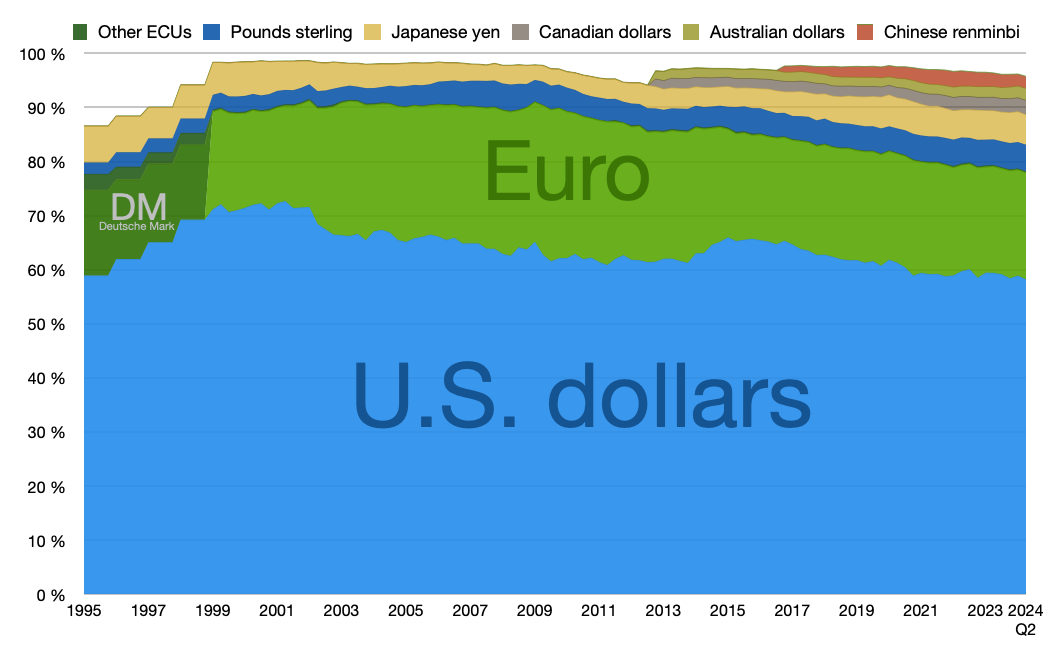

Presently, the U.S. only represents about 4.2 percent of the global population, yet it accounts for almost 25% of global GDP. Approximately 40% of global trade is invoiced in USD, and the USD portion of global reserves is close to 60% (see Chart 1 below) The U.S. also represents about 60% of global stock market value, which is about 10 times Japan’s value, the number two market. No other country comes close to these numbers, and none will challenge us anytime soon. Certainly, our country has lost some global influence in recent years, but with this level of dominance, it’s unlikely that the USD will lose reserve currency status any time soon barring some drastic changes.

Chart 1: Composition of Global Reserve Currencies Held

Reserve currency status also aligns with geopolitical and military power. The USD’s rise was reinforced by America's post-WWII leadership and military reach, both of which are unmatched. Despite recent attacks from right-wingers on our military readiness, our advanced technology and superior training still makes us the most powerful in the world.

All of these factors create a virtuous cycle, where a dominant reserve currency benefits from network effects. That is, the more countries use it as a reserve currency, the more its use is reinforced as the preferred global store of value, medium of exchange, and unit of account. In the near future, there is no competition in regard to these economic purposes. If there is a serious threat in the short-term, it is the U.S. government’s current state of volatility that’s being ushered in by the return of Donald Trump to the Oval Office. Political chaos is not productive in any way

Bullying is Not Leadership

Following World War II, the United States emerged as a global superpower, leveraging its military, economic, and political dominance to shape the postwar world. America directed initiatives to rebuild war-torn Europe through deals like the Marshall Plan and played a central role in establishing key international institutions, such as the United Nations, the International Monetary Fund, and the World Bank, to promote global stability and economic cooperation. The U.S. also spearheaded the creation of collective defense alliances, most notably NATO, to counter the Soviet Union during the Cold War. Domestically, a robust industrial base and technological innovation fueled unprecedented economic growth, solidifying America's role as a leader in the global economy. However, this leadership was not without challenges, including ideological tensions with the Soviet bloc, involvement in conflicts like Korea and Vietnam, and the pressures of maintaining global influence amidst evolving geopolitical landscapes.

American global geopolitical leadership following WWII brought numerous benefits but also came with significant costs, creating in a complex legacy. On the benefits side, U.S. leadership fostered global economic recovery and stability, particularly through initiatives like the Marshall Plan, which revitalized war-torn Europe, and institutions like the IMF and World Bank, which created frameworks for international economic cooperation. The U.S. led establishment of NATO, and other alliances provided security against external threats, helping to prevent another World War while deterring Soviet expansion during the Cold War. worldwide. American leadership also promoted free trade, innovation, and a rules-based international order that enabled economic globalization, raising living standards for many nations

However, these achievements didn’t come without costs. The U.S. frequently bore the financial and military burden of maintaining its leadership, often at the expense of domestic priorities. Engagement in prolonged conflicts, such as the Vietnam and Korean Wars, led to loss of lives, political division, and strained resources. The promotion of American interests occasionally supported authoritarian regimes and provoked anti-American sentiment in various regions. Moreover, the overextension of military and economic power in an attempt to shape global events has, at times, led to unintended consequences, such as destabilization and blowback in areas like the Middle East. Balancing the benefits of leadership with its costs continues to be a central challenge for American foreign policy.

The thing about leadership is that it comes with certain responsibilities. Countries will not want to follow the U.S. if they believe they are being bullied. Certainly, the U.S. is too powerful for any one country to stand up to us. However, if we go on attack against everyone at once in full view of the public, we will destroy much of the goodwill the U.S. built up over the last 80 years. It’s arrogant and foolish to believe that we will be better off treating our allies in this manner. While they will not likely become enemies, it does risk turning them into “frenemies”, and that will create its own costs, both apparent and intangible.

It would seem that Ronald Reagan’s “Shining City on a Hill” has turned pitch black in the Trump era. Humiliating as many foreign leaders as possible, and forcing them to bow down to you, is a strategy designed more for the Middle Ages than the Digital Age. Over the last few months, I’ve spent some time attempting to address and illuminate the economic and social problems we face, as well as the true causes. A “Strong Man” leader such as Donald Trump has no interest in the true causes of these issues, but rather, looks to exploit them. As the old saying goes, don’t let the truth get in the way of a good story - and stories that stoke anger, fear, and resentment motivate people much better than facts and reason. Yet, that anger must have someplace to go – it needs scapegoats. So, we have the “Libtards, Elites, Mainstream Media, illegal immigrants, and Globalists” to blame – and now apparently, all our trading partners.

In the first week of the second Trump presidency, he has already pardoned around 1500 Jan 6 rioters, many of whom attacked police officers with flag poles and tasers, causing hundreds of casualties and even a few deaths. These pardons are so ridiculous that a couple of people have even refused the pardon out of regret, and with the simple admission that they were guilty. Not surprisingly though, some of the most dangerous of the rioters have expressed no regret and have given us every reason to believe they would do it again if they saw fit.

Egregious pardons were only the beginning. Trump has also withdrawn the U.S. from the World Health Organization, the Paris Climate Agreement, and frozen almost all foreign aid. Though, probably the most disgusting thing he’s done is removing security detail for a number of former Trump administration officials who have been targeted by foreign enemies, or right-wing extremists. The only reason he has done this is because these former Trump appointees have criticized his actions. So, for nothing more than ego and spite, these individuals could be targeted by violent extremists or foreign adversaries to be killed. Not that Trump cares.

“Speaking to reporters in North Carolina on Friday, Trump said he would not feel a sense of responsibility if any of the people from whom he had pulled security came to harm.” Source: The Hill

The Most Prevalent Threat to Dollar Dominance

Once again, I’ve gotten pulled away from the core subject, but it was necessary to lay out some details to support my next supposition. From earlier in this piece, you may remember that geopolitical power and stability were important factors in determining global reserve assets. As illustrated above, economically speaking, no one can touch the U.S. Without question, we dominate the world! The attempt to display the U.S. as some kind of doddering fool among all nations, that is being “used and abused”, is utterly silly. It’s nothing more than political diatribe employed to fuel the victim mentality of MAGA, which allows Trump to pose as their hero once again. Constant grievance is the fuel of the MAGA movement, but it is not reality. I’ve made the case before; foreign nations are not the cause of MAGA discontent.

We have Army bases all over the world, and not just to protect those countries. They bring stability globally, which allows commerce to thrive. They also allow us to shape and direct the different geographic regions’ politics more to our benefit. As the U.S. recedes from the global stage, China and other more belligerent nations will gain power, and use it to benefit themselves in ways that are more likely to harm U.S. interests. Global trade could suffer, and we will not be immune.

More trade means more growth overall. World trade is not a game of monopoly. That is, it is not a zero-sum game. There are benefits to all who participate, and global growth benefits the U.S. more than any other country, given that we are 25% of global GDP.

Trump has talked about closing many American military bases around the world premised on the idea that they are too expensive to maintain. The U.S. has about 750 bases spread across 80 different countries, which is more than all other countries combined. Many of these are relics of WWII, and the geopolitics that prevailed during that period. There is an argument for the case that many of these should be closed. However, it should be done strategically in a way that maximizes U.S. interests in a world where China is a larger threat than ever before.

Some Dollar History

Donald Trump has often commented that the USD is overvalued. I tend to agree with that notion, but the reasons for overvaluation are quite complex. First, if you check out Chart 2 below, you can see that the USD goes through cycles over time based on prevailing economic trends.

Chart 2: USD vs. Major Currencies Price Chart

In the late 1990s, the USD appreciated greatly due to U.S. in the global tech space, which accelerated economic growth dramatically, driving financial inflows. After the tech bubble burst in the early 2000s, this trend reversed. The USD fell precipitously as flows in tech stocks reversed, and emerging markets became the preferred investment destination. Global growth was being driven by China, and its unquenchable thirst for commodities. China embarked on a massive buildout that led to a domestic real estate bubble that has yet to be fully overcome. The subsequent commodities boom coincided with a dollar bear market, as U.S. financial asset demand faltered in favor of “real assets”.

When the China/EM/Commodities boom of the 2000s gave way to the Great Financial Crisis (GFC), safe haven demand caused the USD to bottom and eventually drove a new USD bull market. Tech stocks had been in the doldrums for over a decade when the trend finally started to reverse, and this was well before AI became an important element in earnings.

Around 2013, investors could buy Microsoft Stock (MSFT) at a valuation of approximately 9X annual earnings. Presently, investors must pay 33X annual earnings. That is, valuation has tripled in the last 12 years. MSFT is a bell weather of the tech space, so it works well as a proxy for technology and the economy in general. Chart 3 below shows that while tech valuation is not perfectly correlated with USD movements, the long-term trend is undeniable and illustrates that a major driver in the value of the USD is the flow of foreign investment in the U.S. tech space.

Chart 3: Microsoft P/E ratio vs. Dollar Index

The bottom line is the USD goes through long cycles driven more by shifts in technological advancement and investor sentiment than on any policy changes. This last cycle of appreciation is being exacerbated by investor exuberance over AI advancement. Foreign government malfeasance is not the cause. Certainly, the USD is likely overvalued, but this is a cyclical phenomenon.

Reserve Currency Dilemma (Triffin Paradox)

For decades, there has been debate about the U.S. Trade Deficit. That is, we import more goods than we export on a continuing basis. The Trade Account is a portion of the Current Account (CA), with the difference being income flows between the domestic country (U.S.) and the rest of the world (ROW).

The Current Account is a calculation of payments made from trade flows of goods and services, as well as income derived from investments. It makes up one component of the Balance of Payments (BOP) of a country, the others being the Capital Account and the Financial Account. In theory, when added together all of these must equal zero (see picture below). because it is an accounting identity, and every transaction must be categorized.

The Capital Account consists of transfers of non-financial assets (real assets) and the Financial Account is constructed from purchases of financial assets (bonds, stocks, etc.). For our purposes, the reader must simply understand that if the U.S. is running a CA deficit it must be offset by a Capital and/or Financial Account surplus. In other words, if we are importing more foreign goods and services than we are exporting, then foreign investors must purchase U.S. assets (stocks, bonds, etc.) in order to allow the BOP to balance.

Balance of Payments Formula – BOP Must Equal Zero

Source: Balance Of Payments Formula (BOP) - What Is It

What has often been misunderstood is that the USD being the primary reserve currency also makes it the main cause of the U.S. CA Deficit. Called the Triffin Dilemma, or Triffin Paradox, the premise is that USD overvaluation makes U.S. exports more expensive, and foreign goods cheaper, thereby causing the U.S. trade deficit to widen. By using the term overvaluation, I am simply saying it is valued higher than it otherwise would be if the USD was not the primary reserve currency.

In addition to that, the extra demand for U.S. Treasuries lowers interest rates, which entices Americans to take on more debt than they otherwise would. The upshot is here is that the USD being the world’s reserve currency helps create a chronic CA deficit and American over indebtedness. This reality is rarely addressed by policy makers, most likely because they don’t understand it.

Trump Saber Rattling is Counterproductive

Trump has been raining political insanity on the world since his inauguration. When it comes to the dollar as the world’s reserve currency, he has been very clear that there should be no rivals taking share from the USD. His Treasury Secretary nominee, Scott Bessent, stated in confirmation hearings that the USD must remain the world’s reserve currency. So, apparently USD dominance is extremely important to this administration.

The catch here is that the world using USD as a reserve currency is at odds with Trump’s stated intention of lowering our CA deficit (typically only the trade component). The large tariffs he is threatening are mostly for this purpose. It forces foreign countries to hold USD, which will then be invested in U.S. securities. Being on opposite sides of the ledger, the USD must trade at a level that will cause the U.S. CA deficit to be offset by Capital and Financial account surpluses. It’s a relationship that can be dominated by either side at a given time.

For example, an increase in U.S. consumer preference for foreign goods would push the CA deficit higher, requiring inflows of financial capital to balance it out. If interest rates remain the same, the USD would need to depreciate to cheapen U.S. asset prices to entice foreign investors to buy them. But the relationship can also go the other way. Once again, if interest rates remain the same while foreigners hold extra USD as a reserve asset, that extra demand will push the USD higher. This causes foreign goods to be cheaper, enticing U.S. consumers to buy more foreign goods, and increasing the CA deficit. There are many other variables that play into this relationship. Beyond changes in interest rates, stock prices, market sentiment and many other factors are constantly moving, but in the end, the BOP equation must balance, and this is the cause of the Triffin Dillema.

Pissing Off the World

This first week of the new Trump administration has been astounding is how quickly things are happening. Many of Trump’s executive orders, his Cabinet appointees, and his antics have been completely off the reservation. The authors of the Project 2025 must be ecstatic. Certainly, Trump’s MAGA supporters are. They love his gratuitous and performative buffoonery meant to humiliate Democrats, and Republicans alike, along with foreign leaders. MAGA supporters see his bombastic cruelty as “strength”.

However, most average Americans, including some of his own voters, never thought he would actually follow through with all of his campaign promises. They wrote them off as Trump’s usual nonsense. “Take Trump seriously, but not literally” was the standard refrain. Yet, it seems that much of the policy he is implementing is straight out of the Heritage Foundation’s Project 2025, which is a Libertarian’s fever dream that had no real chance to be implemented. Or at least that’s what most people thought. After claiming repeatedly that he knew nothing about Project 2025, Trump seems to be trying to quickly implement as much of it as possible. I don’t see this ending well for either Trump or the country. Project 2025 polled horribly among Americans. Even MAGA Republicans don’t like it.

“Among independents, 52% report feeling negatively about the plan, while 85% of Democrats say the same. About 33% of Republicans say they also view the plan negatively, with just 7% saying they have positive views of the plan, which Trump has criticized since Democrats ramped up efforts to tie him and Project 2025 together.

Voters who identify as "MAGA Republicans" reported viewing Project 2025 in a slightly more positive light, with 28% saying they held negative views and 9% saying they view the plan positively.

It was the least popular of all the subjects tested in the September NBC News poll — a battery that included socialism, capitalism, both presidential and vice-presidential candidates, the Republican and Democratic parties, Taylor Swift and Elon Musk.”

Source NBC: Poll: Project 2025 is broadly known and severely unpopular with voters

Trump has taken alienating both our military allies and trading partners to a new level in his new administration. “America First” isolationism is the prevailing sentiment in the MAGA movement, but history has not shown it to be a winning philosophy. The U.S. practiced it in the 1920s-30s until the Japanese attack on Pearl Harbor woke us from our stupor. Ignoring the problems of the world will not make them go away and repeatedly bashing our allies and trading partners to score political points risks turning the U.S. from a global leader into an ogre.

At various points in the future, the U.S. will need cooperation from other countries. The world has no choice but to deal with the U.S. because of our extremely dominant position in the world, but given this administration’s direction, they’ll be much less inclined to make moves favorable to the U.S. His “Mad King” approach may work against limited enemies in a military standoff, but it won’t work against the whole world at once on a broad range of issues. To believe so is rank arrogance.

The USD’s position as a reserve currency is unlikely to be replaced any time soon, but Trump is giving much of the world reason to look at other options. This is exact opposite of his intent. It’s only been a week, but if this last week is any indication, we’re in for one hell of a ride over the next four years.