Federal Reserve as Scapegoat

There has been a lot of criticism of the Federal Reserve over the years, and much of it is well-deserved. Many blame the Fed for causing the Great Financial Crisis (GFC) through lack of adequate oversight and by fueling asset bubbles with overly aggressive monetary stimulus following the Tech Bubble Crash, which reflated a bubble in housing and subprime mortgage-backed securities. More recently, during Covid shutdowns the Fed purchased U.S. Treasuries and mortgage-backed securities in double the amount as they did during the GFC, pushing the total assets on its balance sheet to over $9 Trillion. Other global central banks followed suit, igniting what many have come to call the “Everything Bubble”.

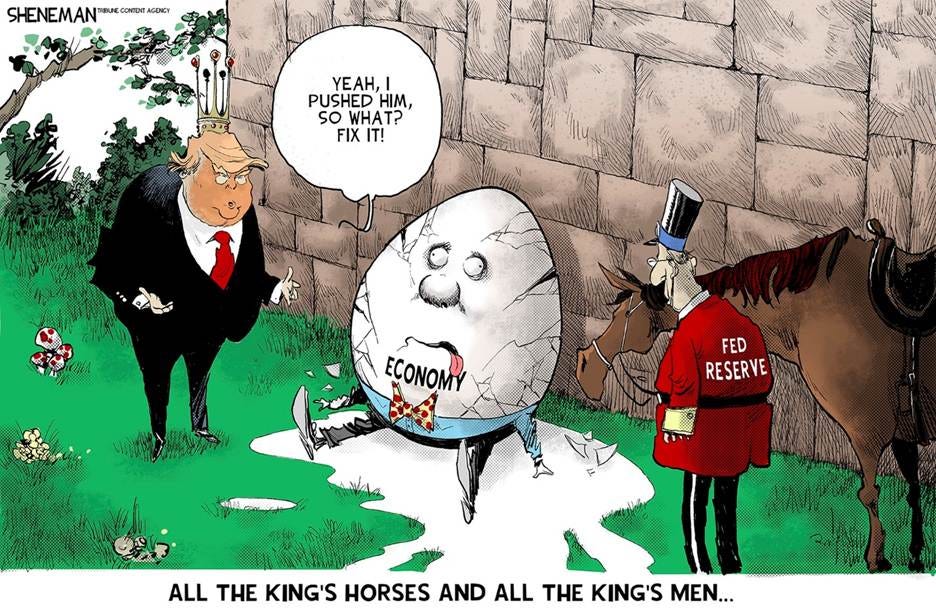

Wall Streeters love to call out the Fed for policy ‘mistakes’. Unfortunately, in many minds, any outcome that includes a recession is considered a mistake. In a perfect world there would be no recessions, but we live in the real world. There are times when some weakness is necessary to flush out excessive leverage, bad investments, or persistent inflation. In those times, if the Federal Reserve leans too hard toward providing quick liquidity to support overpriced, leveraged assets, it creates bigger problems in the future (crashes, crises, etc.) This is an extremely relevant point for our current economic circumstances, as Donald Trump has recently verbally attacked Federal Reserve Chairman Jerome Powell and threatened to fire him.

As this initially played out two weeks ago, the market rally that began two weeks ago started to roll over. In his usual statesmanlike manner, Trump’s antics of attacking Powell via press and social media, calling him “a major loser”, and “Mr. Too Late”, caused many serious investors to worry about what that could mean for future inflation and market stability.

Someone must have gotten in Trump’s ear a bit about how spooking the markets in this manner contains no upside for him. As we have seen Donald Trump attempt to dictate issues where historically the president has had no say, his rhetoric has brought the issue of central bank independence into the spotlight. History is full of horror stories where central banks did the bidding of political leaders who installed disastrous policies. For the last century, the general view is that central banks should be free from political influence as much as possible.

Central Bank Independence

Central Bank Independence (CBI) refers to the freedom of a country's central bank to set monetary policy without direct political interference. Having CBI guarantees that policies around interest rates, inflation targeting, and money supply management are made based on objective economic assessments rather than being driven by political bias. An independent central bank can prioritize long-term economic health over the immediate demands of political leaders seeking electoral advantage.

Central banks play a crucial role in managing an economy by setting monetary policy, managing inflation, and ideally, ensuring the stability of the financial system. In the U.S., the Federal Reserve is charged with what we call a “dual mandate”. The Fed’s job is to promote full employment along with low and stable inflation. Full employment is a bit of a misnomer. At any given time, there are always people without jobs due to structural issues (e.g. job skills vs. long-term market needs) and cyclical swings. Plus, there are always fluctuations in individual businesses’ needs, as well as personal issues, where people may choose to be unemployed temporarily.

The economic paradigm that has developed over the last several decades is called NAIRU. It stands for the Nonaccelerating Inflation Rate of Unemployment. Simply put, it is the rate of unemployment at which inflation is expected to stay stable. Ideally, inflation at this level will be around 2%. One of the first questions people often ask is, “why not zero”. A perfectly commonsensical question that we’ll go into deeper another time, but the quick answer is that at zero inflation becomes difficult to manage around the zero bound and can slip into deflation, and deflation is the fuel for severe economic downturns, such as the Great Depression.

One of the many misunderstood elements of monetary policy is the time lag involved. The effects of changes in policy take on average about 9 months. As famous economist Milton Friedman proclaimed, “it’s like driving a car using only the rear-view mirror”. A rather apt description. The financial media and individuals analyze inflation in short time periods. Inflation data comes out monthly, and with every new monthly print, the professionals are trying to determine which way the Federal Reserve is leaning (cuts, hikes, etc.). Individuals look at their bills for groceries, utilities, and gasoline to get a feel for which way inflation is going. However, the Fed is always thinking about the long term. Each monthly print is just one point in a data trend, and the Fed is navigating a multi-year timeline.

Keys to Long-term Economic Stability

Along with its mandate for full employment, there is an embedded understanding that this can only exist in a state of long-term stability. On the most fundamental level, the basic conditions for long-term stability are:

1. Stable Inflation.

2. Balance between the short-term and long-term economic goals.

3. Non-monetary policies conducive to maintaining numbers 1 and 2 above.

Stable inflation goes without saying. Number 2, balancing short and long-term economic goals, is where most problems arise. There may be difficulty in determining how to find this equilibrium, but the Fed knows that the balance is key. If short and long-term goals don’t mesh, then they may be working contrary to one another, which may put all objectives at risk. However, when politics enters the equation (number 3), all bets are off. Such fanciful ideas about the long-term good of the economy take a backseat when an election is at stake. A new president has 4 years to make “good” things happen in the economy and deliver on promises, or he’s gone. A central bank that allows politicians to dictate their policies can lose credibility quickly. Once that happens, markets start pricing in higher future inflation, and more economic volatility.

Presidential Jawboning

Donald Trump isn’t the first president to criticize the Federal Reserve for not cutting rates. Fed history is rife with presidents taking shots at the Fed Chairmans during their tenure. However, Donald Trump is no ordinary president. No matter whether he tries to fire Fed Chairman Jerome Powell in the next few months, or if he waits a year for when Powell’s term is up to appoint someone new, investors have no reason to feel comfortable with the way future monetary policy will shake out. Trump has already illustrated that he has little understanding of trade economics, by implementing his disastrous tariff policy. Why should we expect that he understands the complexities of monetary policy enough to bring in a proper expert to run the Fed?

If anything, Trump has shown a penchant appointing top officials with little or no qualifications for the job. One thing they do have in common is that they have no trouble doing whatever he asks – legal or not. We’ve already seen Defense Secretary Hegseth sharing pre-battle plans on a public app (twice!). In previous administrations, multiple heads would have rolled by now. As it is, the Trump White House is trying to act as if nothing was wrong with top secret military plans being shared on a public app that can easily be hacked by foreign enemies. Anyone who has spent the last 15 years without their heads buried in the sand knows that if Democrat had done this, not only would Republicans be calling for firings, but they’d also be looking to send people to jail! Rank incompetence and lack of accountability are the calling cards here. Appointing a Fed chairman similar in substance to Trump’s Cabinet appointees could be disastrous for long-term economic health in the U.S.

Playing the Long Game

Central banks must take a very long-term view, because the effects of monetary policy unfold over extended periods, central banks must focus on long-term outcomes rather than short-term political goals. Interest rate adjustments and other monetary interventions often take months or even years to fully impact inflation, employment, and growth. Political leaders, by contrast, are often incentivized to prioritize immediate economic boosts that align with electoral cycles, even at the cost of future instability. An independent central bank can resist these pressures, allowing it to implement policies that may be unpopular in the short run but are necessary for sustainable economic health over time.

Politicians often have strong incentives to favor short-term economic growth, particularly in the period leading up to elections. Policies that stimulate immediate job creation, consumer spending, or financial market gains can boost public approval and improve reelection prospects. However, these short-term strategies frequently come at the expense of long-term economic stability. Rate cuts that may juice the economy over the next year may come as a package deal with inflation in the following year.

The dangers of politicized monetary policy are profound. When governments exert pressure on central banks to prioritize short-term economic expansion over inflation control, it can lead to severe outcomes such as hyperinflation, destructive boom-bust cycles, and fiscal dominance—where central banks are compelled to finance government deficits by printing money. These scenarios erode the real value of savings, destabilize financial markets, and ultimately result in lower long-term growth and widespread economic hardship. Independent central banks act as critical safeguards against these risks by focusing on maintaining price stability and sustainable long-term economic conditions.

History offers clear examples of the consequences of political interference in monetary policy. In Zimbabwe (2007-09) and Weimar Germany (after WWI), government pressures to finance massive fiscal deficits by printing money led to catastrophic hyperinflation, decimating economic and social order. In Germany, this event is believed to have played a large part in the rise of Adolph Hitler. In the United States during the 1970s, political pressure on the Federal Reserve contributed to the persistence of high inflation. Presidents Johnson and Nixon sought loose monetary conditions to bolster growth, resulting in a decade of stagflation that took a painful monetary tightening campaign under Paul Volcker in the early 1980s to finally correct.

One Million Mark Bill - https://americangerman.institute/2023/12/hyperinflation-weimar/

Zimbabwe money printed in a single year showing how hyperinflation leads to higher and higher denominations being needed.

As for the U.S., in our current predicament, hyperinflation is unlikely. Presently, we have competent bankers running the Fed, and it would be extremely unlikely that excessive inflation would be allowed to exist for any length of time. Although some pundits love to throw out the hyperinflation bogie man, a much more likely outcome is stagflation. The number one question since Trump rolled out his tariff plans, is would it cause inflation? Assuming the tariffs stay in place, there will be a “price level” change – which means a price rise as a one-off adjustment. Whether that becomes recurring (inflation) depends on what happens afterward.

The fear in the current situation is that all this leads to an escalating back and forth between us and our trading partners that creates an ongoing inflation problem. For his part, Chairman Powell has expressed his belief that it likely will. And not only that, but tariffs will also weaken growth. Trump tariffs likely to raise inflation, slow US economic growth: Fed | AP News

As we’re seeing now, the initial fallout from Trump’s tariffs will likely be a volume response. The 145% tariffs on China have already led to a massive drop off in U.S. port traffic. Experts are forecasting a lot of empty store shelves in the near future unless something changes very quickly. The port of Los Angelas is seeing a -33% YoY drop in freight traffic from China. Even if importers swallow some of the initial tariff cost for consumers, empty store shelves must lead to a fall in economic activity. Right now, it’s only affecting dock workers and truck drivers, but in a few months, everyone will be feeling it.

Building Credibility

Empirical research strongly supports the idea that countries with independent central banks experience lower average inflation rates. Studies comparing inflation rates across different nations consistently find that central bank autonomy correlates with better control of price levels, without sacrificing economic growth. By insulating monetary policy from political influence, independent central banks can prioritize long-term objectives like price stability, thereby fostering a healthier environment for investment, savings, and sustainable growth.

Additional research shows that central bank independence is closely tied to greater credibility and better-anchored inflation expectations among households, businesses, and investors. When a central bank is perceived as free from political manipulation, markets are more likely to believe its commitment to maintaining low and stable inflation. This credibility, in turn, makes monetary policy more effective: inflation expectations become self-fulfilling, and central banks can achieve price stability with smaller and less disruptive interventions, reducing the overall cost to the economy.

One of the clearest examples of the benefits of central bank independence can be seen in the U.S. after the appointment of Paul Volcker as Chair of the Federal Reserve in 1979. Confronted with runaway inflation, Volcker pursued aggressive monetary tightening despite significant political resistance and short-term economic pain. His policies eventually succeeded in breaking the back of inflation, restoring the Fed’s credibility, and laying the groundwork for the prolonged period of economic stability and growth that followed in the 1980s and 1990s. Volcker’s tenure highlights how central bank independence can be essential in achieving difficult but necessary economic reforms.

Market trust in the central bank's commitment to stability is fundamental to the effective functioning of modern economies. When businesses, investors, and consumers believe that the central bank will act decisively to maintain low and predictable inflation, they plan their economic activities with greater confidence. This trust reduces uncertainty, encourages investment, and supports healthier long-term economic growth. An independent central bank is better able to cultivate and maintain this credibility because it is free from short-term political pressures that could otherwise undermine its commitment to stability.

Credibility also plays a crucial role in reducing the economic cost of disinflation—that is, the effort to bring down high inflation rates. When inflation expectations are firmly anchored, central banks can tighten monetary policy without triggering severe recessions or destabilizing financial markets. In contrast, if markets doubt a central bank’s resolve, bringing inflation under control often requires much harsher policy moves, leading to greater economic pain. Independence helps ensure that monetary policy is both credible and effective, minimizing the social and economic costs associated with maintaining price stability.

Furthermore, an independent reputation enables central banks to use advanced tools such as forward guidance and inflation targeting with greater success. Forward guidance—communicating future policy intentions to influence market expectations—relies heavily on the public’s belief that the central bank will follow through on its stated goals. Similarly, setting explicit inflation targets can shape behavior only if the institution is trusted to prioritize those targets above political considerations. Independence thus strengthens the central bank’s ability to manage expectations proactively and stabilize the economy with less aggressive interventions.

The insulation of monetary policy from short-term political motives remains essential for sustaining economic stability and growth. Central bank independence protects the economy from the dangers of politically driven monetary decisions, such as runaway inflation, asset bubbles, and fiscal dominance. By maintaining autonomy, central banks can focus on achieving long-term objectives like price stability and sustainable employment, rather than succumbing to the shifting demands of electoral cycles.

Ultimately, Central Bank Independence is the foundation for credibility of monetary policy It anchors long-term inflation expectations and fosters a stable environment for investment and economic planning. It is not merely a procedural preference but a foundational pillar of modern macroeconomic management. In an increasingly complex and politically volatile global economy, defending and strengthening central bank independence is more critical than ever. It is not a luxury—it is a necessity for securing the future stability and prosperity of nations.

Stepping away from the theory, and back into the real world - Donald Trump is almost guaranteed to keep going after Jerome Powell until his term is up, or he lowers rates. We may not have to wait that long though. Today we got 1Q GDP for the U.S., and it turned out slightly negative. There’s a lot of noise in the data. It seems there were a great deal of products imported in Q1 to get ahead of the tariffs. The next 2 quarters will provide more clarity, once the trade flows “normalize”, for lack of a better word. Nothing is going to normal for a while. The year of chaos is only one quarter of the way through. Buckle up!

Let’s Get Ready to Rumble

Disclaimer:

The information provided in this newsletter is for educational and informational purposes only and should not be considered as investment advice, a recommendation, or an offer to buy or sell any securities. The views expressed are based on personal opinions and analysis of market conditions, which are subject to change at any time without notice. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers are advised to conduct their own research or consult with a qualified financial advisor before making any investment decisions. The publisher is not responsible for any investment decisions made based on the information provided in this newsletter.