Here We Go Again

More Tariff Nonsense

The world gave a massive collective sigh of relief when Donald Trump extended his original “retaliatory tariffs” that he imposed on April 1st of this year out for 90 days. That deadline was to be reached on Wednesday, but Trump has extended the deadline to August 1. The administration released a new list of tariff rates this week for several countries, with promises for more to follow. In some cases, the rates are higher than the original rates. Once again, we have some low income, underdeveloped countries such as Laos and Myanmar set to have huge draconian rates imposed that will wreak havoc on their economies. As an example, 80% of Bangladeshi exports are textiles, and incomes are a fraction of what they are in the U.S. Yet, they are being threatened with 35% tariffs on August 1 as though they are an economic threat. There is literally no rhyme or reason for such a policy. No trade deals with these little countries will have any meaningful effect on our trade deficit. The fact is we have virtually nothing to gain from these bullying tactics.

Much noise has been made by the Trump administration about how these tariffs are meant to bring foreign nations to the table, and they have touting how many deals were in the works for the last 3 months. However, the reality of trade deals is that they usually take years to negotiate, because of a host of interested parties in each country, and the internal politics involved. Trying to jam deals down the throat of every country in the world in a matter of months is a strategy fraught with peril. After our first 90 day reprieve, where the administration promised “90 deals in 90 days”, we have 2 - and those are only broad outlines. At this point, there has been virtually nothing to show for all the turmoil except a loss of American prestige and respect. The U.S. has spent several decades building up goodwill around the world, and Donald Trump has destroyed much of it in less than a year.

Extreme market volatility in April caused Trump to back down and impose a much lowered across the board tariff of 10% with the 90 day pause. Along with this, a U.S. trade court determined the Trump Tariffs to be illegal. Despite that fact, the tariffs remain in effect for now in order to allow the Trump administration to appeal the ruling. Market jitters have completely subsided for now, with both the SPX and the NDX reaching brand new highs.

TACO Trade in Full Effect

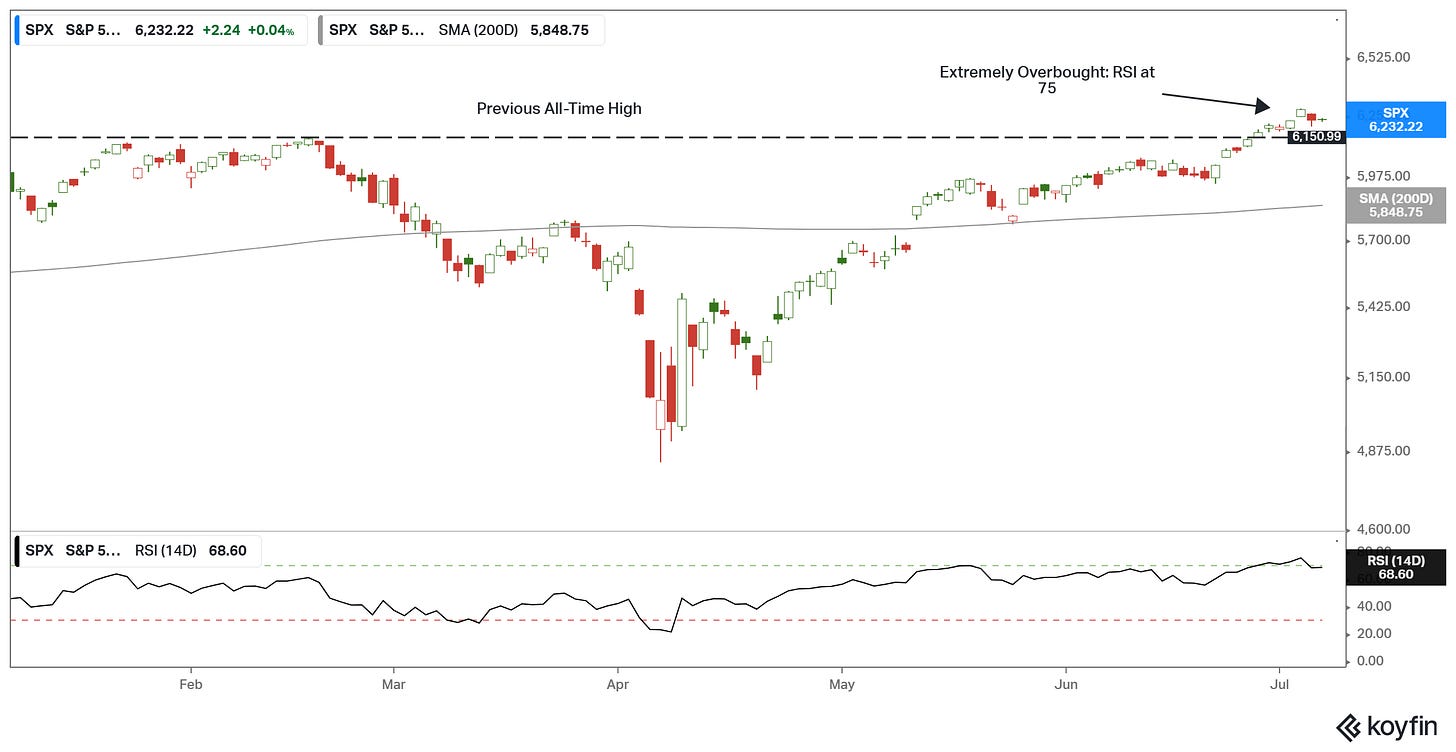

The TACO trade (Trump Always Chickens Out) has been the driving force behind this three month rally. (See Chart 1 below). Trump has telegraphed his brinkmanship approach quite thoroughly over the last few months - which has led investors to believe no significant tariffs will actually take effect. Interestingly, these are the sort of situations that can give rise to substantial market events. If markets stay near the highs, or go higher, and it turns out that these tariffs are put into effect, then we will be looking at a repeat of the April mini-crash. Markets are pricing virtually zero chance of that happening.

Upon hearing the news of new Trump tariffs on Monday, markets sold off, but there seemed to be no particular panic in the trading action. The RSI for the SPX hit 75 last week - a highly overbought level. Panic selling in April gave way to FOMO (Fear of Missing Out) in May and June. This sort of whipsaw action is normal in these periods of extreme uncertainty. Even if investors understand what the Trump administration is trying to accomplish, no one can make sense of his strategy. This new round of tariffs may simply be Trump taking another shot at scaring countries into signing deals. There’s no reason to believe it will work any better this time around, and investors know that. With markets where they are presently, the rationale must be that Trump will back down again.

Chart 1

In the meantime, we have a little over three weeks of waiting, in the middle of summer, and with a market ripe for a correction. No doubt the passing of Trump’s “Big Beautiful Bill” (BBB) has further ignited speculative juices. Significant deregulation, and extreme cost cutting are expected to supercharge economic growth. In reality, deregulation typically will boost growth, but it’s not costless. Certainly, more focused and efficient regulation is always preferred, but much of what we’ve seen so far is more draconian, and will cause more pollution and other negative externalities, in excess of any improvement in growth.

Yet, the biggest stimulative effect will be a ton more deficit spending. Despite the normal tough talk from Republican “deficit hawks”, they have completely abdicated their fiscal responsibility by acquiescing to Trump on the BBB. A number of them complained about the Medicaid cuts, and how these would cause rural hospitals to close, and ultimately, create significant economic pain on their own constituents. On top of that, there was no reason this bill had to be rushed through with almost no real debate. Trump set a July 4 deadline arbitrarily, because he wanted the association of signing the bill on Independence Day. That’s show business folks - just selling the sizzle - and it is no way to run a country.

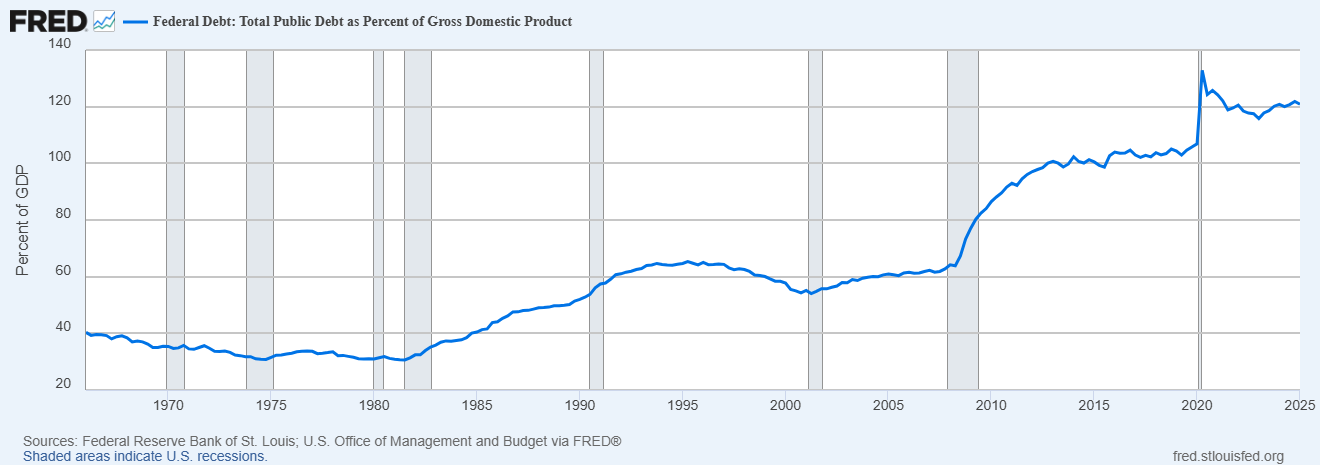

Even as a kid, DA remembers hearing adults and newscasters express worries about the federal deficit. Looking back at the 1980s, it seems quaint now. Chart 2 below shows that, in the mid ‘80s, debt only accounted for about 40% of GDP. We can see the effect of supply-side economic policy during this time that caused the ratio to rise about 60%. Reversal of these policies in the ‘90s, along with the boom of the tech bubble, produced one of the rare occasions where the ratio declined. Debt levels remained steady through most of the 2000s until the Great Financial Crisis (GFC) hit. After initial surge to 100% through 2014, it steadied out again until Covid hit.

Chart 2: U.S. Federal Debt as a Percentage of GDP

Federal Reserve Bank of St. Louis - FRED

While it can be argued (and DA has) that the GFC and the Covid Pandemic are the primary reason for the explosion in debt to GDP, there is no political hay to be made here. Or at least there shouldn’t be. Both Republicans and Democrats voted for the extraordinary stimulus (causing massive deficits) that occurred during these crises, as well they should have, considering they were both existential crises that could have led to a replay of the Great Depression. However, now we are not in the midst of a financial meltdown, and growth has actually been somewhat steady. These are the times where the smart thing to do is tighten our belts, and pay down some debt. Tax receipts always fall during recession, causing deficits to rise. This underscores the reality - that you need fiscal room to run deficits during recessions by taking advantage of the extra revenue in the good times.

This rule of thumb was already violated in Trump’s first term, when the TCJA cuts took place with little to no offsets. We were nine years into an expansion when these cuts took place. While no one could have predicted the economic crisis of Covid, expansions usually don’t last much longer than that. So, it would have been prudent to provide offsetting spending cuts with the tax cuts. Unfortunately, prudence is a dying art in today’s world.

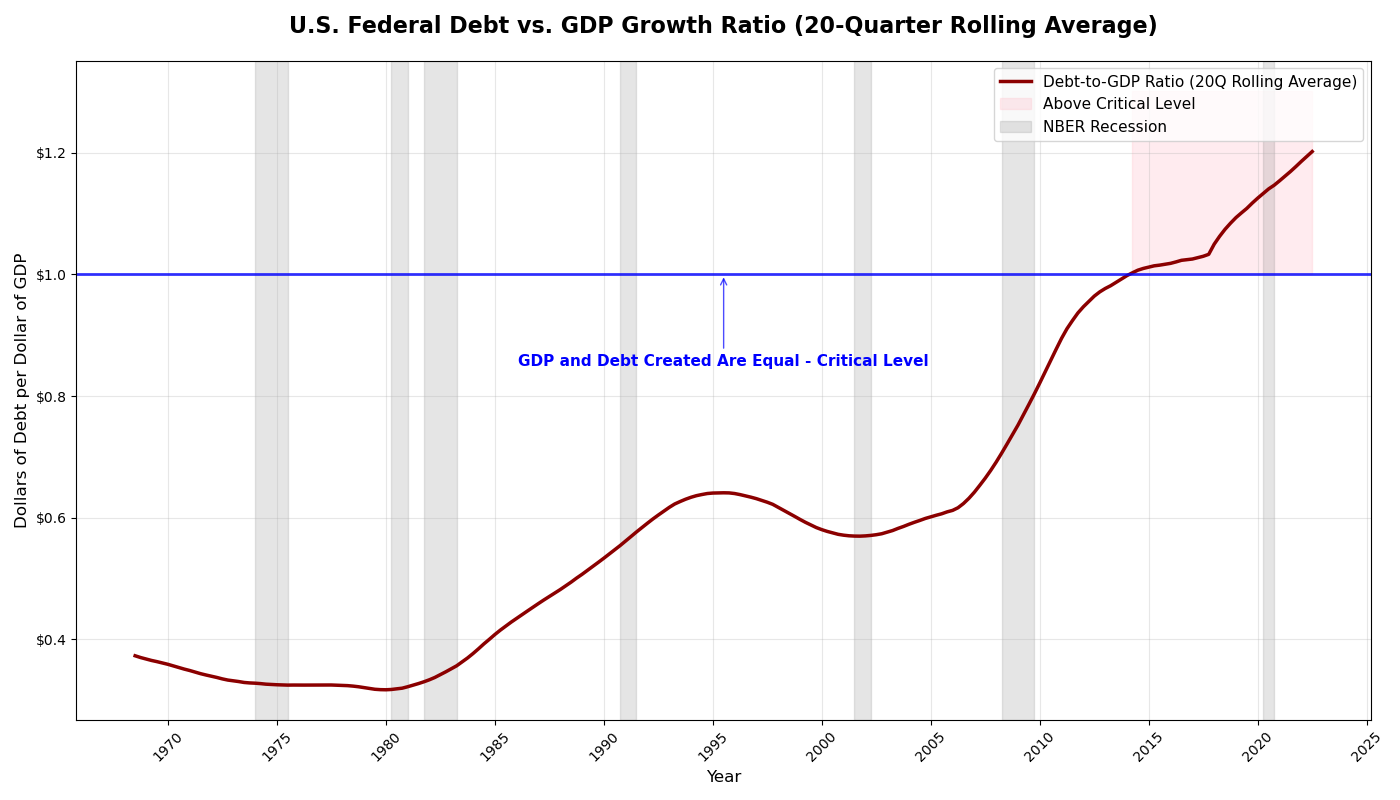

Chart 3 is an illustration of the dangerous position we are in now. It shows the amount of debt that has been needed to create $1 of GDP over the last 55 years. The measure takes the change in debt divided by GDP nominal growth quarterly, then takes a 5 year rolling average (20 quarters) in order to smooth out short term volatility. Around 1980, it only took about 35 cents of federal government debt creation to produce $1 of GDP growth. Back in 2015, that level crossed the $1 to $1 level, and is now sitting around $1.20 of debt to produce $1 of GDP growth.

A couple of things need to be noted. First, we’re not implying that federal debt is the only driver of growth. There are many factors to consider in the production of economic growth. At its simplest level, economic growth is created from a combination of population growth (generally working age population) and productivity growth. Second, while this is definitely a flashing danger signal, there is still the possibility that it doesn’t trigger another crisis. Some things need to happen, or not happen to keep this thing going.

Chart 3: Amount of Debt Used to Create Each Dollar of Growth (5 Yr. Rolling Avg.)

Federal Reserve Bank of St. Louis - FRED

Avoiding Catastrophe

First of all, the market needs to be right about TACO. Not 100% necessarily, but right for the most part. Trump’s persistent kicking of the can down the road, has grown tiresome, and nobody is buying it anymore. Not surprisingly, his ego has been somewhat bruised by being called a “chicken”. We should all remember for as long as he is in office, a Donald whose manhood has been challenged is a dangerous Donald! From Bloomberg:

“Trump, who fashions himself a brilliant dealmaker and strategist despite ample evidence to the contrary, is, of course, always going to bristle at the notion that he is a chicken — and a predictable one at that. He also routinely peddles himself as an infallible winner, so the nastiest question is also one that speculates about whether he’s mired in a losing streak. His tariff policy, unleashed on allies and competitors alike, has been rolled out on a seesaw and riddled with economically damaging ineptitude.

Trump will never acknowledge any of that, which is to be expected. But it also may be wise to consider this TACO-fueled moment as something other than a lighthearted interlude in an otherwise tragicomic policy miasma. Trump protects and prioritizes how his various audiences perceive him. A Trump eager to prove he’s not a chicken is a Trump willing to inflict economic, social or political damage in the service of his ego and self-image (also a recurring feature of his earlier but less consequential passage as a real estate developer and casino operator). Dangers loom.”

Bloomberg - Timothy L. O'Brien - “This TACO Gives Trump Indigestion, So Watch Out”

I would also add to this by stating that, with the passing of Trump’s BBB, he is more likely to push the tariff issue. He feels emboldened. Plus, his irrational belief in the growth boosting power of the BBB may make him think that the markets will react better this time. Rationality would dictate that these new tariffs will never take effect. The nasty selloff in April should have taught Trump a lesson about how damaging tariffs at these levels would be. But we must remember, this is a man who has continued to say the 2020 election was stolen despite the fact he paid two separate firms to investigate, but who found nothing, and no court of law has given any credence to the claims, because there is simply no evidence.

Trump has been pitching a mercantilist policy of high tariffs since the 1980s, and there is little evidence he even knows how they work. For weeks, he has been bragging about how much revenue the tariffs have brought in, apparently oblivious to the fact that the tariffs are paid by importers, not foreign countries, and these costs are eventually passed on to consumers. There’s a strong argument that markets should be pricing a 20% or so chance that there will be some extra noise before or around August 1. Maybe we don’t get a full implementation of the tariffs, but it’s quite possible that the outcome isn’t as rosy as the markets are pricing.

Anyone who doubts this need only look at what Trump is doing with Brazil right now. Trump has threatened to impose a sweeping 50 % tariff on all Brazilian imports starting August 1, branding the ongoing trial of ex‑President Jair Bolsonaro - who’s been indicted for an alleged 2023 coup attempt - as an “international disgrace” and a politically motivated “witch hunt”. Basically, Bolsonaro did almost exactly what Trump did on after he lost the 2020 election. He claimed that the Brazilian presidential election was rigged against him, and attempted to overthrow it. Trump sees him as an ally, and a partner in crime. This is pure insanity!

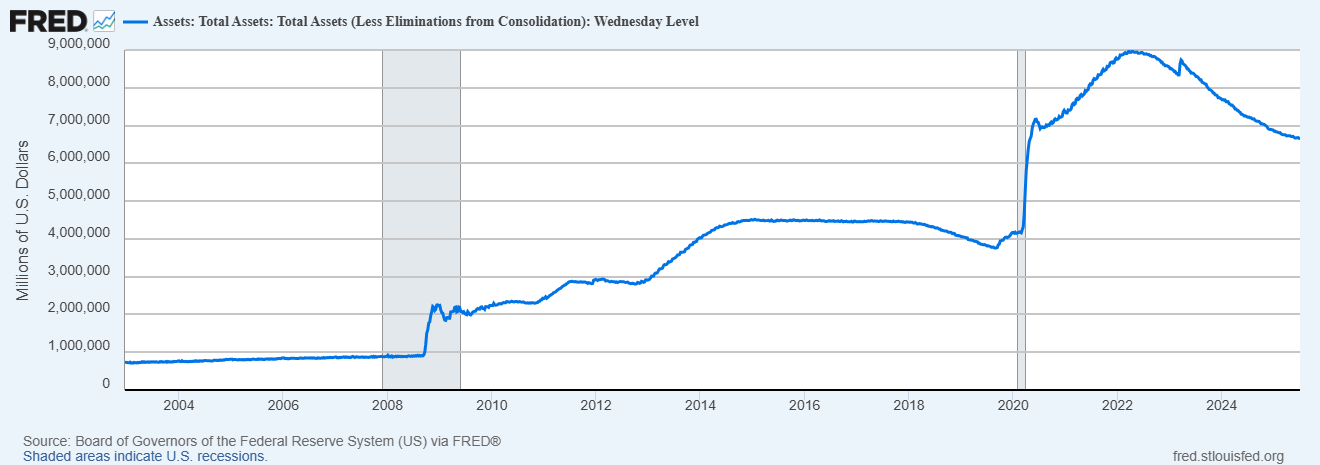

Next, we need the Fed to keep the liquidity flowing enough to justify present levels. Since 2022, when the Fed removed the Zero Interest Rate Policy (ZIRP), and started raising rates at a rapid pace, the U.S. economy has been surprisingly resilient. DA has spoken of this many times. It’s quite likely that the Federal Reserve’s massive balance sheet is the reason. Chart 4 below shows that the Fed’s balance sheet just recently dipped below $7 Trillion for the first time since Covid hit. Back in 2008, it was less than $1 Trillion, and growing about 4.5% a year. That would have projected to a present level of $2.1 Trillion. So - effectively, they’ve been monetizing a huge amount of debt, since the government basically is paying the coupons on those bonds to itself. More than that, roughly $5 Trillion in marketable securities (mostly Treasuries) have been removed from the investable universe, and replaced with cash. Undoubtedly, this has put a strong bid under all U.S. markets.

Chart 4: Federal Reserve Balance Sheet

Lastly, AI hype needs to, at a minimum, stay steady - and maybe, in order to keep deficits from blowing out to dangerous levels, it needs to morph into a bubble. The rationale here is that the last time we were able to run a federal budget surplus was in the late 1990s, when the tech bubble was raging. Higher equity prices generally fuel more consumption, which leads to better growth. To be fair, we don’t need surpluses to lower our debt level, we just need to grow more than our debt does.

Regardless, DA has no faith in an economic boom that will allow tax cuts to “pay for themselves”. Particularly given that tax rates are lower now than they were during the tech bubble. Yet, from a practical standpoint, this would provide the short-term benefit of keeping our debt from spinning out of control, and creating a crisis. Of course, the price could be a significant misallocation of capital, but that would be easier to mop up.

Once again, we find ourselves in a precarious situation. If we get to August 1 with markets still at these levels, and Trump refuses to back down again (even for a short period), look out below. Trump has already had his bluff called once - it’s not a foregone conclusion that he would allow that to happen again. If we’re predicting what he will do based on the rational choice, then we’re not being rational. Trade accordingly.

The Devil’s Advocate

Disclaimer:

The information provided in this newsletter is for educational and informational purposes only and should not be considered as investment advice, a recommendation, or an offer to buy or sell any securities. The views expressed are based on personal opinions and analysis of market conditions, which are subject to change at any time without notice. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers are advised to conduct their own research or consult with a qualified financial advisor before making any investment decisions. The publisher is not responsible for any investment decisions made based on the information provided in this newsletter.