Us poor Americans.☹ The world is so mean to us. For instance, we’re ONLY 25% of global GDP, and 70% of global equity market cap, but we’re about 4.25% of global population! Aren’t we entitled to so much more? I mean, we have also had the fastest growing economy since coming out of the Covid shutdowns. But hey, don’t you still feel used and abused by the likes of Thailand, or Lesotho? Don’t worry though, my great American patriots - Donald Trump is going to fix it all for us. Right?

“Don’t Fix What Ain’t Broke”

Market reactions around the world are a huge clue that something is majorly wrong with Donald Trump’s new tariff policy, but the Trump spin is that we will experience short-term pain for long-term gain. DA believes this is based a complete lack of understanding of how international trade works. It assumes international trade is a “zero sum game” when it isn’t. Both trade surplus and trade deficit countries benefit from trade – otherwise, they wouldn’t do it. What seems most critical right now is to create an understanding as to why this trade war is so nonsensical. The more people get that, the more likely public pressure will be able to force an end to it.

Trump contends our trade deficit “subsidizes” other countries and that it is purely a function of everyone taking advantage of us. The basis of this belief hails back over a century to the debunked economic theory of mercantilism. The crux of the theory is that the way to maximize wealth in a country is to run large, consistent current account surpluses (focusing on the trade component). On its face, this would seem to make perfect sense, which is why the theory held sway for hundreds of years. Even when gold was considered the primary form of money, the notion was fundamentally flawed. In a modern economy driven by globalization, comparative advantage, and deep, liquid financial markets, this is even more the case. In an interconnected world, restricting imports and hoarding exports leads to inefficiencies, higher consumer prices that stifle growth. Countries thrive not by accumulating gold or trade surpluses but by fostering innovation, capital investment, and specialization, which drive productivity and long-term prosperity. Historically, empirical evidence has shown that open economies with dynamic trade policies—such as Germany, South Korea, and Singapore—consistently outperform protectionist ones in GDP growth and living standards.

Here’s what the Trump administration, and “Average Joes” of the MAGA persuasion don’t get. The United States has the lowest trade to GDP ratio of any economy in the world sans certain very economically undeveloped countries. Why does this matter? Because it means our economy is more insulated from the global economy than any other country. It’s been said that “when the U.S. sneezes, the world catches a cold”. The reverse is sometimes true as well, but a global recession is usually weathered by the U.S. much better than other countries, and our lower trade exposure is a large reason.

U.S. economic power is partly rooted in our relatively high population (around 350 million), which is 3rd in the world. China and India both have over 4 times as many people as us, but we are vastly more developed, wealthy, and diversified. Our low percentage of trade to GDP “protects” us somewhat to fluctuations in the global economy. Chart1 shows the average level of trade (exports plus imports) as a percentage of GDP since 1970. While the average level is around 60% now, back in 1970 it was only 25%. When the MAGA movement rails against “globalization” this is what they’re talking about. In a globalizing economy, more advanced economies move toward higher value-added industries, while lesser-developed economies see growth in the industries previously abandoned by advanced economies. The laws of comparative advantage are such that all economies gain under free trade. At least, that’s the theory. However, it is a gross oversimplification of reality.

Chart 1: Global Trade as a Percentage of Global GDP

Source: World Bank Trade (% of GDP) | Data

Generally, to the world, free trade leads to the best possible economic outcome. However, very small and undeveloped economies are at a huge disadvantage. Even countries that are somewhat larger may have enormous exposure to trade (some over 100%!). In addition, many also have a small number of industries that are enormously important to their economy. While across the board tariffs rarely make much sense, strategic tariffs to protect crucial industries for a particular country can be justifiable. For the U.S., tariffs in industries such as defense, steel, and aluminum might be considered necessary at times for national security purposes.

Let’s look at our neighbor to the north – Canada. Canada trade is equal to 67% of GDP, relative to our 25%. Our population is 10 times bigger as well. 20% of Canada’s exports are energy, and another 10% are metals. This means that 1/3 of their exports are low value-added commodities that are volatile, and extremely sensitive to the global economy. The upshot that Canada is much more vulnerable economically than the U.S.to fluctuations in the world economy. It’s not surprising that they would set up some protective barriers for certain industries.

The European Union has a whopping 96% trade to GDP ratio. For all the people who seem to believe that other countries are all taking advantage of the U.S., DA would like to point out that there is no country in the world competitive with the U.S. that can use their domestic economy to offset global weakness like we do. Based on their exposure to trade, the EU has around 4 times the correlation to the global economy as the U.S. This is a common theme with around the world. However, the United States is in the exalted position of not needing to be nearly as concerned about external economic conditions as our trading partners.

History of the world is about the struggle for power. Those who have access to the most resources command the most power. In this regard, the United States has been in the cat bird seat for most of the last century. Trump and his MAGA cohorts have attempted to sell some nightmarish version of reality which has no basis in reality. Rightly, Trump has pointed out that during a trade war the surplus countries get hurt more. This is true in the sense that trade wars shrink overall economic activity, and those with the surpluses will see growth slow more. Yet, we are the ones with the best ability to offset external weakness with domestic strength. By pretending this is not the case, the U.S. looks like nothing but a bully to the world. We already possess most of the economic power, and this policy seeks to gain more while pretending to be a victim. This alone is enough to make all our trading partners furious. God knows we would be.

Mobster Shakedown

As an extreme version of the point being made, the reader need only look at Lesotho. Most folks have probably never heard of it. Lesotho is embedded within the country of South Africa. It only has about 2.5 million people while the U.S. has 350 million. Its largest industry is agriculture, at 57%. Its GDP per capita is about $2500 a year vs. the United States’ $75,000. At 50%, the Trump administration has slapped the largest tariffs of any country in the world on Lesotho. Does this seem like a fair fight??? What exactly is this meant to accomplish? What are we going to export to a country where the average daily wage is about $5? This is utterly ridiculous! Donald Trump has the United States looking like a mobster doing a shakedown. We are turning ourselves into a global ogre, and the long-term consequences of that are nothing but negative.

3 Primary Reasons the U.S. Has Such a Large Current Account Deficit

1. The USD is the dominant international reserve currency (Triffin Dilemma). (see King Dollar - by Ryan Atkinson - The Devil's Advocate)

2. The U.S. presently has a very large Federal Budget Deficit.

3. The USD is too expensive.

Triffin Dilemma – A Chronic Problem

We have spoken of the Triffin Dilemma before. As the world’s primary reserve currency, the USD will always be relatively expensive due to the necessity of foreign nations and private companies which deal in international trade holding excess USD to do business. The higher USD will spur Americans to buy more foreign goods, because they’re cheaper, and less American goods because they’re relatively more expensive. Naturally, that will put pressure on the U.S. trade deficit to worsen. One upside is that the U.S. will tend to have lower interest rates than it otherwise would, but with the downside of a tendency to accumulate more debt.

Large Federal Budget Deficit

Due to both political parties (“The 2 Santas”) in the U.S. wanting to satisfy constituents, there is a chronic budget deficit at the federal level. If GDP growth is enough to offset the size of the deficit, everything is fine, and the Debt to GDP level stays flat. However, when you have economic crises like the Great Financial Crisis and Covid, government spending will act as an automatic stabilizer for the economy by offsetting economic weakness in the private sector. This is why U.S. Debt to GDP has doubled in the last 15 years. Budget deficits automatically increase on economic downturns because economic weakness means the Treasury brings in less revenue. On top of that, there are automatic stabilizers in the U.S. economy such as unemployment insurance, and in the case of extreme crises such as the GFC and Covid, the government usually implements other costly programs to support the economy. While it’s debatable if spending during these periods didn’t need to be as high as it was, there should be zero doubt that doing nothing would have guaranteed a second Great Depression.

The U.S. Dollar is Overvalued

This is a cyclical phenomenon. Chart 2 shows the USD index (DXY) since the U.S. went off the gold standard in 1971. The reader can see massive cyclical fluctuations as long-term secular trends. The last two bull runs in the dollar (1990s, 2010 to now) coincided with huge bull markets in U.S. tech stocks. This has flooded the U.S. with foreign investment capital looking to take advantage of the mega tech stock mania. With that trend having played out for now, the USD is now valued at roughly the same level as the end of the 1990s tech bubble. As previously noted, a higher valued dollar (highest in 25 years) leads to more imports, and less exports, and a bigger trade deficit.

Chart 2: U.S. Dollar Index Chart

Uncertainty Isn’t Going Anywhere

The USD will continue to be the world’s reserve currency for years to come, but the expensive dollar is a cyclical phenomenon that looks to be ending, and the current large budget deficit must be dealt with by making hard choices about cutting spending or looking at some form of tax hikes. Of course, budget issues are always a hornet’s nest, and Republicans obsession with cutting taxes makes cutting the deficit more difficult, as it would need to be offset by spending cuts. As for the high level of the USD, over the next several years, depreciation seems likely driven by a shift in the secular cycle. Massive inflows into USD assets are already reversing. However, in the short-term, the USD could appreciate as a safe haven currency if market turmoil persists.

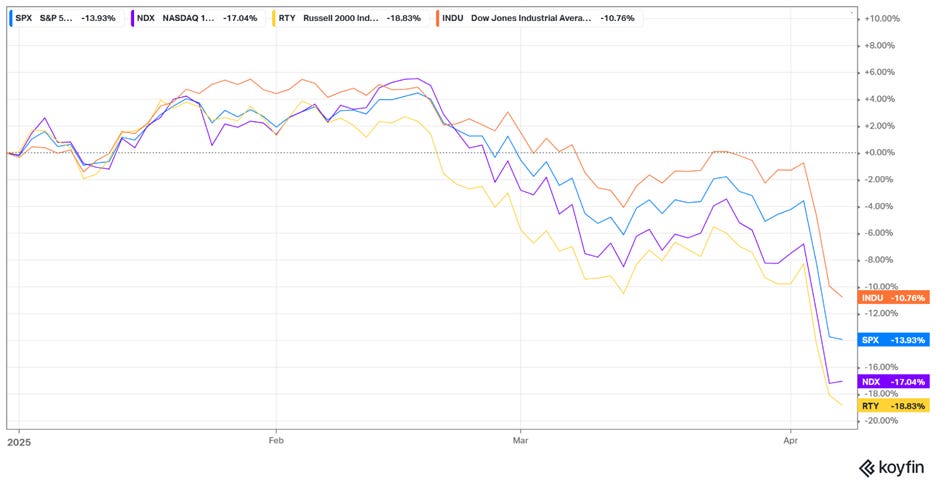

Chart 3 shows Major U.S. Equity Index returns since the beginning of 2025. As can be seen, they were down modestly ahead of Donald Trump’s announcement of tariffs, but afterward, stocks went into free fall around the world. The Nasdaq 100 (NDX) flirted with the arbitrary -20% delineation of a “bear market” today before rumors of foreign countries looking to negotiate helped put in a bottom. Volatility has been excessive, as investors still have no clue what will actually happen. For his part, Trump’s public statements have done nothing to help calm markets. Common sense would dictate that Trump is looking to make deals, but he seems to want to create maximum leverage in any negotiations first. In effect the world’s economy is being held hostage to a madman U.S. president. Or at least that’s what he wants us to think. It remains to be seen whether Trump is applying “Madman Theory”, or if he is truly mad. One thing is for sure though, if he’s faking, he’s doing a damn good job. The whole world is scared as hell - and it should be.

Chart 3: U.S. Major Equity Indexes Year to Date Returns

Disclaimer:

The information provided in this newsletter is for educational and informational purposes only and should not be considered as investment advice, a recommendation, or an offer to buy or sell any securities. The views expressed are based on personal opinions and analysis of market conditions, which are subject to change at any time without notice. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers are advised to conduct their own research or consult with a qualified financial advisor before making any investment decisions. The publisher is not responsible for any investment decisions made based on the information provided in this newsletter.