A Garden Variety Market Correction

In the past few weeks, the SPX dropped as much as -10%, before finding a near-term bottom, and attempting to bounce. As is typical, the chattering classes from mainstream media have maximized eyeballs and clicks by selling the fear of people losing their retirement funds, and the financial press has gone through their normal routine of parading out long-only money managers to tell you to buy the dip. So far, it’s mostly according to script. The exception would be that just like everything else, the mainstream media message on the economy is bifurcated by political viewpoint, which is unfortunately a sign of the times.

At a glance, this is a typical market correction. A -10% market drop is nothing to get too disturbed about, in and of itself. Every bull market experiences at least a couple of these. Corrections are par for the course, and are sometimes necessary to clear out near term excesses, so that the bull run can continue. At the time, the catalyst for the selloff may seem dire, or it may be rather trivial, but the pattern is the same.

However, as my piece from last week laid out, I don’t believe this is just a basic correction. It would seem the imbalances of investment flows have reached extreme levels in the last couple of years, after a decade plus trend. Combined with the headwinds being created by this new administration, dominoes have been lining up, and unless there’s a significant change in tone around the burgeoning trade war, are likely about to get knocked down.

Chart 1 below shows the SPX with RSI and the 200 Day Moving Average (DMA). The recent pullback has brought us below the 200 DMA, and RSI registered as oversold last week. The oversold RSI reading foreshadowed the modest rally we’ve had over the last few trading days, and that’s exactly what we’ve had. What comes next is what I like to call a “technical imperative”. That is, it’s a guideline for technical analysis that almost always will be the case. Having breached the 200 DMA, and finding an oversold bottom, the first move is a retest of the 200 DMA. It doesn’t matter if there’s to be a continuation of the bull market, or if we have already entered a bear market, this is the most likely near term move.

Chart 1: SPX with Relative Strength Index (RSI) and 200 DMA

Last week I floated the notion that there’s an 80% probability that we have seen the top in the market this year. That view is directed at the U.S. market in particular. Global markets may or may not continue to perform well, depending on how the trade war plays out. On a cyclical basis, things are starting to look shaky. Although, for the most part the “hard data” (actual economic statistics) have held up reasonably well so far, but “soft data” (surveys) are showing substantial cracks. Economic uncertainty is skyrocketing. Uncertainty and fear are close cousins, and it’s difficult for markets to advance under such conditions. Many Wall Street banks are starting to raise recession odds, some as high as 50%!

Completing the setup, we have seen U.S. market performance trounce most every market over the last decade, powered by mega cap tech stocks. Much of this has been driven by exuberance over breakthroughs in Artificial Intelligence (AI), but as is common when new technology is being developed, hype has likely gotten ahead of reality. From a bigger picture perspective, over a decade of investment flows into the U.S. is already starting to reverse, and that will have major implications for investors over the next several years.

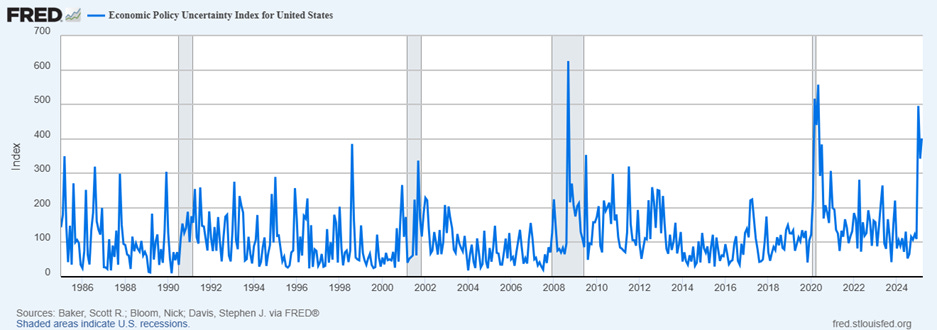

In chart 2, we have the Economic Uncertainty Index for the U.S. Over the last 40 years, there were only two other times the index was at this level: the Great Financial Crisis, and during the Covid shutdowns. Obviously, both of these periods were times of great turmoil where markets were reeling. Presently, we’re not experiencing a crisis, so one might say this measure isn’t meaningful. A further counterargument would be that the current uncertainty contains upsides due to the perceived benefits of the Trump administration’s economic policies (i.e. cutting taxes and regulation). Certainly, this was the market viewpoint directly after the presidential election, but Trump’s aggressive tariff stance has blown that view out of the water.

Chart 2: U.S. Economic Policy Uncertainty

Along with the extraordinary unpredictability of Trump, and the prospect of ongoing tariff negotiations, investors must also come to grips with a tectonic shift in how the rule of law will be applied going forward. This past weekend, Trump’s aggressive attempts to deport illegal immigrants led to over 200 Venezuelans being flown to an El Salvador prison. Ostensibly, all these individuals were violent criminals associated with the brutal Venezuelan gang Tren de Arugua.

Many of these people have no U.S. criminal record, but were alleged to be tied to the gang. Evidence backing this this up seems to be rather dubious. Certainly, there are some who fall into this basket, but the likelihood of innocent people being swept up in this government operation is fairly high. In doing this, Trump invoked the Alien Enemies Act of 1798, which previously has only been used during times of war. Since illegal immigration doesn’t constitute a state of war outside of MAGA fever swamps, that alone may make this action illegal. On that basis, a federal judge attempted to halt the deportations, but it seems the Trump Administration ignored the ruling. This happened along with MAGA acolytes calling for the impeachment of the judge on that basis - or seemingly, any judge who stands in the way of the Trump agenda. Supreme Court Chief Justice Roberts flatly rejecting that possibility, highlighting the severity of this situation, Elon Musk is pledging money to Republicans who will pursue impeachment of judges not backing the Trump agenda. The free world is increasingly worried.

While economic fear has spiked to a level virtually guaranteeing a respite from the market selloff, we continue to feel the slow burn of authoritarian encroachment coming from the executive branch. Many of the executive orders Trump has signed since inauguration may have been unconstitutional, and are being fought in court. There’s nothing wrong with that – it’s called due process. What’s scary is the prospect that Trump will eventually outright ignore a court ruling, which would shake our constitutional republic to its very foundations. It’s not clear what would happen after that, but such events are typically a prelude to a “liberal democracy” becoming an “illiberal democracy”. Basic rights and individual liberties then start to dissolve, as the government can no longer be held accountable by its citizens. This is why the United States has been added to the CIVICUS Monitor Watchlist, a research tool that publicizes the status of freedoms and threats to civil liberties worldwide. It should go without saying that this isn’t the type of list Americans should want to be on, and foreign investors don’t like it either.

The Demise of American Exceptionalism

American exceptionalism is the belief that the United States is either distinctive, unique, or exemplary compared to other nations. In actuality, it is a rather opaque concept that means different things to different people. Regardless, Trump’s focus on transactional relationships even with our closest allies is causing untold damage to the U.S. on the global stage. The cost of this can’t be measured by the level of the SPX, or any particular quarter’s GDP. Assuming the country doesn’t pull off a rather quick about face, the effects will felt slowly over the course of decades.

Currently, U.S. dominance of the world is so readily apparent that no rational person can deny it. This is why it’s so astonishing to hear Donald Trump repeatedly tell us how we have been put upon by the rest of the world. His latest phrase is he’s “bringing wealth back”. I’m not sure where it supposedly went. Although our population is less than 5% of the world’s population, our equity market is 70% of global market cap!!! Trump has called the U.S. the “garbage can for the world”, which could only be true if global investment capital is considered garbage.😊 We are around 25% of global GDP as well. These are mind boggling numbers if you think about it, and they’ve only gotten better in recent years, as U.S. GDP growth has beaten every other developed country. If the rest of the world is an albatross around our neck, then how is this possible?

Rockefeller International chairman, Ruchir Sharmahas, recently referred to “American Exceptionalism” is a bubble that is bursting. I believe that is a misuse of the term, as he is obviously speaking of capital flows over the last 15 years as opposed to the almost century old period of U.S. global dominance in public affairs. However, I do believe these two things are coming together at this point in time in a most inopportune way.

Germany is Poised for Reflation

There’s a great deal going on in the world right now, so if the reader missed what’s going on in Germany, they can give themselves a break. As of just a few weeks ago, commentary on the German economy was especially dismal – calling for a possible return to a dark economic period in the 1995-2003 period, where Germany was referred to as the “sick man of Europe”, and GDP growth averaged about +1.1% per year.

As much as I’ve outlined how I think the current administration’s policies are woefully misguided ((1, 2, 3), all the turmoil is producing some positive effects. Although, not necessarily for the U.S. (for now at least). For decades, the whole of Europe has struggled to grow on a level with the U.S. “Eurosclerosis” is the term coined to refer to the sort of stagnant economic growth in Europe, believed to be caused by high taxes and excessive regulation. It also has very poor demographics, with an aging population, which weighs on growth.

On top of that, Germany has long had a reputation as being governed by extreme deficit hawks, who sought to limit debt and deficits as much as possible. This propensity is a relic of the tumultuous 1920s Weimar Republic, where hyperinflation ravaged the German economy due to money printing in order to pay WWI reparations. Since WWII, German has been staunchly for currency stability, low inflation, and tight budgets. As well, having started two World Wars, Germans have been adamantly opposed to building up their military strength again. Yet suddenly —the tide is turning.

Trump’s belligerent attitude toward Europe combined with his conciliatory approach to dealing with Vladimir Putin has awakened the policy makers in Germany. They now see it as imperative to boost military spending to deal with the Russian threat, as Trump seems ready to abandon our former ally Ukraine, and disconnect from the world in general. Failure to take action on the part of the European powers now could mean leaving themselves vulnerable to power grabs from darker global forces in the future (e.g. Russia and China).

“Germany has officially introduced a significant infrastructure fund and exempted defense spending above 1% of GDP from debt limits. The measures are intended to mitigate economic stagnation and geopolitical challenges, including Russian aggression and reduced support from President Donald Trump. Economists have predicted the measures could boost Germany’s growth to 1.5-2% annually by 2027.

Robin Winkler, Deutsche Bank’s chief economist for Germany, said, “Both the speed at which this is happening and the magnitude of the prospective fiscal expansion is reminiscent of German reunification — though the underlying geopolitical shift driving today’s developments is far less benign than 35 years ago.”

The reforms, requiring two-thirds parliamentary approval, include changes to state-level debt limits and could result in over €1 trillion in spending over the next decade. Deutsche Bank’s Jim Reid said, “Everything you thought you knew about Germany’s economic prospects 3 months ago, or even 3 weeks ago, should be ripped up and you should start your analysis from fresh.””

Germany only has about one quarter of the population of the U.S. A one trillion Euro stimulus over the next decade would be like four trillion dollars for the U.S., which is MASSIVE! It’s also likely that other European Union countries will follow suit. Assuming this comes to pass (odds look good), we look to be on the cusp of a multi-year reflationary period for Germany, and possibly, the whole European Union. For European investors, this couldn’t come at a better time.

A Watershed Moment

Chart 3 below shows the Vanguard Europe ETF (VGK) along with the S & P 500 ETF (SPY) during the most recent bull market that started in late 2022. The correlation is undeniable, with the two moving together in lock step (directionally speaking) over the last few years. That is, until November’s election, which brought Trump back to office. The immediate response from the market was to create a blow off top in the U.S. market as investors discounted anticipated tax cuts and deregulation. Since January though, for various reasons (1, 2), the script has been flipped. Global investors’ response to Trump policy has been to flee U.S. markets, with allocations registering their biggest drop ever among fund managers.

Chart 3: Europe ETF with SPX (vertical line denotes Nov. 4 Election)

Conventional wisdom, which has been expressed by the U.S. Treasury Secretary, Scott Bessent, is that during a trade war the countries with trade surpluses suffer most. Generally speaking that is true. All else equal, surplus countries have more to lose from ending the relationship, but the current situation may not play out that way. Trump’s approach has angered our trading partners to such an extent that they are likely now looking to retaliate beyond their leaders simply slapping on reciprocal tariffs. Citizens of these countries are forming their own boycotts of American products. There is actually an app available to Canadians to help plan their purchases to maximize pain to U.S. businesses. No one should blame them given the ghastly rhetoric from Trump about Canada becoming our 51st state. Sovereign countries don’t like to joke about their sovereignty. Especially when it seems like they’re being extorted into giving it up (see: Donald Trump Says 'Nasty' Canada 'Meant To Be 51st State').

All of this is unfolding after a huge 15-year run of outperformance by the U.S. stock market. Chart 4 below shows the primary German stock index (DAX) to U.S. Index (SPX) Ratio. The U.S. has torched the world in equity return and GDP growth in recent years. The upshot of that means that the world is as heavily long U.S. equities, particularly mega cap tech, as it’s ever been. My personal experience bears this out, as individual investor portfolios I’ve reviewed in the last few years have been heavily overweight the U.S., and in many cases, contained zero foreign equity exposure. While I don’t expect the American retail investor to immediately embrace foreign stocks en masse, professionals and foreign investors are moving hard in that direction. Individual investors will eventually follow. Multi-year trends cannot be corrected over a course of months. While the reversal doesn’t have to be comparable duration or size to the initial trend, it will usually result in another multi-year trend. That’s what I believe we’re looking at, a major new secular trend.

Given the sharp move higher in outperformance for foreign markets relative to the rest of the world, a correction may be in order in the short run. While the U.S. markets became oversold, European markets were becoming overbought. But that’s a short-term issue. Investors would do well to get ahead of this trend, and start shifting some of the allocation into non-U.S. stocks.

Chart 4: Germany (DAX) to U.S. (SPX) Ratio

Disclaimer:

The information provided in this newsletter is for educational and informational purposes only and should not be considered as investment advice, a recommendation, or an offer to buy or sell any securities. The views expressed are based on personal opinions and analysis of market conditions, which are subject to change at any time without notice. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers are advised to conduct their own research or consult with a qualified financial advisor before making any investment decisions. The publisher is not responsible for any investment decisions made based on the information provided in this newsletter.