Staring Into the Abyss

Scary Market Volatility

The market has been digesting the tumultuous news on tariff policy from the Trump administration over the last few weeks. Trump’s initial tariffs had investors staring into a deep dark hole in the global economy that had major stock indexes dropping -5% or more on multiple days. Whether we just stare into the hole rather than falling in remains to be seen. Despite tough talk, Trump postponed these tariffs in favor of 10% across the board tariffs, except with China, which would receive tariffs in excess of 100%. While the Trump administration has proclaimed this was the intent all along, it would seem that the ill effects on the market were the real catalyst. The type of volatility we’ve seen only comes about when there is a systemic risk to the global economy.

To illustrate this point, see Chart 1 below. It is a chart of the CBOE Volatility Index (VIX). Last week the VIX hit levels we’ve only seen twice before in the previous 20 years. During the GFC and Covid shutdowns, the VIX spiked over 80. While the highest we’ve seen so far is around 55 (now down below 30), these is still a huge risk over the Trump tariffs. Had Trump not backed down from the initial catastrophic level of his “reciprocal” tariffs, it’s likely the VIX would have spiked to similar levels as 2008 and 2020. Even with only 10% tariffs across the board (excluding China), analysis shows that it is still effectively larger than the famously ill-timed Smoot-Hawley tariffs of 1930. While not the cause of the Great Depression, the Smoot-Hawley tariffs are generally considered to be a major exacerbating catalyst for the biggest market meltdown and economic depression in American history.

Chart 1: CBOE Volatility Index (VIX)

Nothing to Fear but Fear Itself?

At this point, uncertainty alone is enough to throw us into recession. Businesses all over the world need to have a view of what future policy is going to be when they implement their business plans. If they don’t, then they are more likely to do nothing, which lowers economic growth. In the extreme, this can trigger a recession. Trump wants to strongarm the entire world into submission to his view of how the global economy should be structured. The problem is that his vision is contradictory, incoherent, and complete economic nonsense.

One day, Trump is touting replacing the income tax with tariffs, the next day he’s telling us that the tariffs will lead to a manufacturing renaissance. MAGA voters seem really excited about the prospect of getting rid of the income tax and replacing it with tariffs. Why not? It’s being billed as an “economic free lunch”! Of course, anyone who has ever taken an economic course knows “there is no such thing as a free lunch”. Hidden or not, there is always a cost to offset a benefit. It may be spread among many entities, or over time, but it is always there.

Given the amount of press tariffs have generated in the last few weeks, it would be reasonable to think that everyone now knows that tariffs get passed on to the consumer. But common sense is not as common as we’d like to think. Importers pay the tariff, then they raise their prices for consumers. They don’t always pass on the entire cost of the tariff to retain customers, but there’s still a cost in the sense that their profits are lowered. Either way, the full cost is paid either by American consumers, or American businesses. Meaning the United States pays the full cost of the tariff.

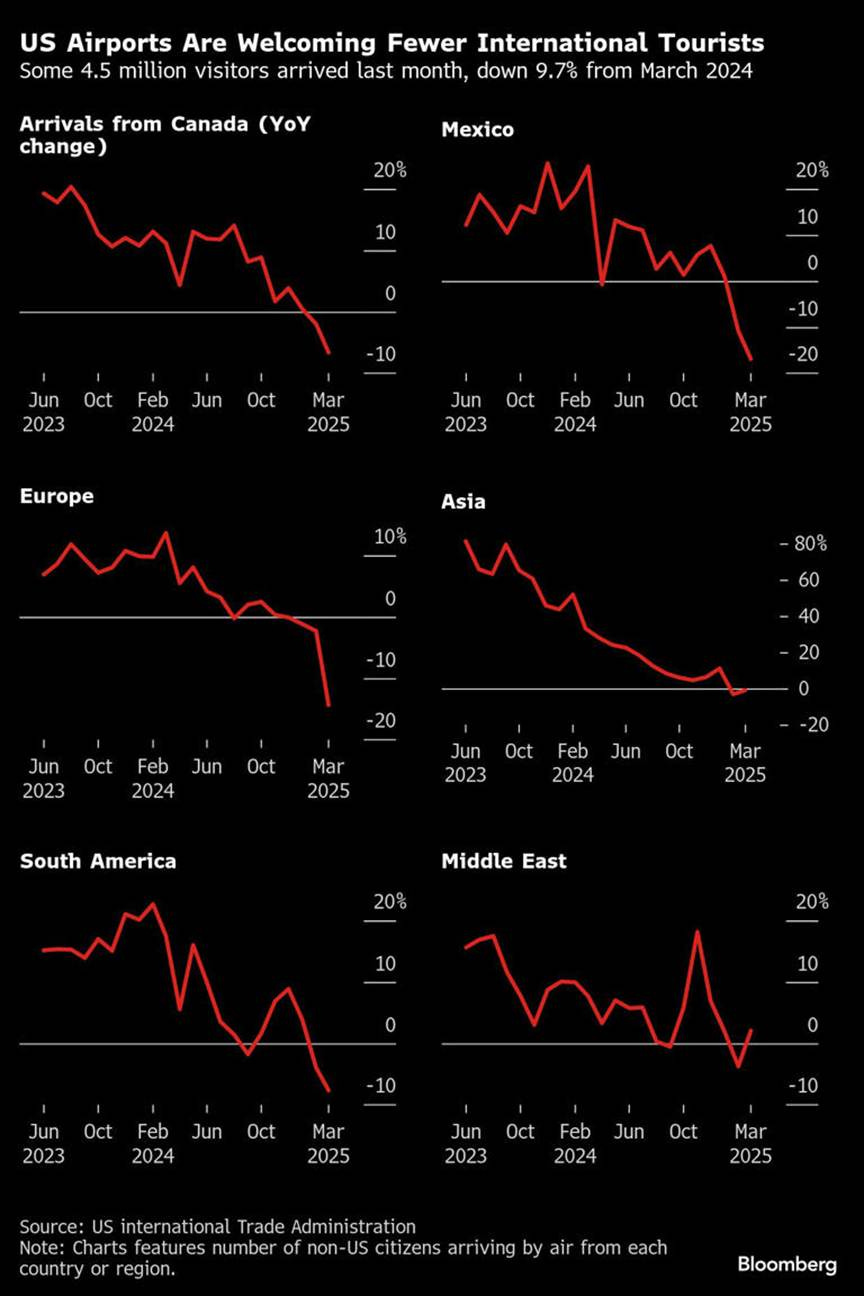

The philosophy that Trump seems to be basing his tariff policy on is called Mercantilism, and was refuted by philosopher/economist David Hume almost 300 years ago! Yet, humans being hardheaded, there has still been a number of times the world had to suffer through trade wars because previous lessons go unlearned. Contrary to what Donald Trump has publicly stated, no one ever wins a trade war. He is correct in the sense that other countries with large surpluses will be hurt worse, but his assumption that they will all cave to U.S. demands in the end is woefully misguided. Within three months, Trump has insulted and denigrated every one of our allies and trade partners. Some country’s citizens have been organizing boycotts of American products, and many are refusing to visit the U.S. on vacation (tourism is an export). Tourism to the U.S. from almost all global regions are down year over year. (See Chart 2).

Chart 2: Global Tourism to U.S. Collapsing

In 3 months, Donald Trump has destroyed 75 years of goodwill we’d built up around the world. There is zero upside to this. The silly notion that the world has taken advantage of us and has cost us money has no basis in fact. We dominate the world economically like no other modern country ever has. We own a huge share of global wealth in proportion to our size, and much of this is due to having the world’s reserve currency, along with immense respect. Presently, we cannot be trusted to follow our own internal rules, much less abide by the world order we have built over the last several decades. This will cause unexpected trends that Americans will eventually see as detrimental, but timeline on that may be a decade or more.

Globally Synchronized Downturn

An interesting thing happens when global asset markets start to get spooked. Correlations rise everywhere. Not just among stocks, but among all risky assets. Asset classes that usually don’t correlate start moving in lockstep. Chart 3 shows the USD Index (DXY), SPX, and Crude Oil. Prior to Inauguration Day, correlations among these three assets showed no clear pattern. However, since Inauguration Day, all three assets fell off a cliff together. This is an obvious sign that what is going on has global implications that aren’t pretty.

Chart 3: USD Index (DXY) with SPX and Crude Oil Futures (CL1)

A Confluence of Negative Events

I hate the term “Perfect Storm” – it’s been used to death since the Clooney/Wahlberg movie came out in summer 2000. However, it has a better ring than “confluence of negative events” and is definitely an apt description of the current situation. There is a major market regime shift occurring. Here is an inexhaustive list of what’s going on:

1. Tech Stock Dominance Ending - After a decade of mega cap U.S. tech stocks massively outperforming the rest of the world (ROW), a reversal is taking place. With many of these stocks having traded at a discount to the SPX in 2014, the largest mega caps topped out with valuations double the SPX.

2. U.S. Dollar Collapsing - Tech stock dominance and the U.S. economy outperforming the ROW drove the USD to 20+ year highs. Yet, natural cyclical effects are coinciding with Trump’s erratic actions to drive foreign investors out of the dollar.

3. Trade War Ongoing - Trump’s tariff hikes will raise overall tariffs to levels comparable to the Smoot-Hawley Act, which is believed to have worsened the Great Depression. This is having a chilling effect on global markets. Laughably, Donald Trump has stated the Great Depression would have been avoided if we had higher tariffs in the 1930s.

4. Record Debt to GDP – Debt levels in the U.S. leave little room for error on fiscal policy. Further rises in U.S. budget deficits could cause long-term interest rates on U.S. Treasuries to reach dangerous levels, where interest costs exceed growth. A global recession could lower tax receipts even further below expenditures, worsening the deficit. Even before this happens, the MAGA war on government agencies (DOGE) includes the IRS, which is believed by many exports to portend a massive drop in tax receipts due to cuts in the agency. This couldn’t happen at a worse time.

On top of the purely economic events above, U.S. strength is being undermined in various ways. Our constitutional republic is on shaky ground, and that’s bad news for the entire free world. Which makes it bad for business.

1. DOGE (Department of Government Efficiency) – The completely arbitrary shuttering of certain government agencies based on MAGA principles is causing an immediate loss of jobs. However, this is only the beginning. Most agencies are being gutted, and this will likely create extra difficulties in the long-run rather than savings, as needed government benefits are impeded.

2. Mass Deportations – While it’s still early in the game on the deportation front, it still has the potential to cause problems for certain industries staffing. Insanely, now Trump is floating an idea to legalize some migrant workers, which flies in the face of the extreme anti-immigration rhetoric he has engaged in over the last decade (despite a personal history using illegal labor).

3. A Record Number of Executive Orders – Over half of these are being challenged based on constitutionality.

4. Executive Orders Attacking Law Firms – Trump has issued specific orders blocking some of the most powerful law firms in the country from doing business with the government that have represented opponents to any of his policies. In a nutshell, this is extortion, and will do great damage to the rule of law. Many of these executive orders are blatantly unconstitutional, and challenge ability of Trump’s opponents to defend against them. Yet, rather than lose a significant portion of their business, several of these powerful law firms have rolled over. This means that many who may want to fight back against illegal orders coming out of the administration may have trouble finding legal representation.

5. Ripping Up Prior Trade Deals – in Trump’s first term, he made a huge deal about renegotiating NAFTA. NAFTA’s replacement was the United States-Mexico-Canada Agreement (USMCA). Now Trump has backed out on that deal. Which begs the question – why would anyone trust Trump in another deal?

6. Executive Orders Attacking Individuals – Trump has recently issued EOs to investigate government officials who have criticized him. This is a blatant attack on the first amendment.

6. Executive Orders Attacking Higher Education – Trump is attacking elite universities based on their policies. He has threatened to stop funding for any school that doesn’t share his worldview. Thankfully, some are fighting back.

7. Attacking Free Speech – Trump has railed against “wokeness”, the rebranded term for political correctness, as being anti-free speech. This has been the conservative viewpoint for some time, but it ignores that the “woke” pressure generally comes from private entities with no means of enforcement. Yet, now Trump is regularly attempting to stifle any opinions through his executive power. Once again, this is blatantly unconstitutional.

8. Targeting People Who Refuted His 2020 Election Claim – Despite four years with literally no evidence to support the claim that the 2020 election was rigged against him, Donald Trump still refuses to accept reality. Even worse, he is aiming to ruin people’s lives to punish them for publicly opposing his delusion.

Making the World Safe for Authoritarians

This is one hell of a list, and it’s still not exhaustive. The bottom line is that the world is being forced to accept a United States that isn’t at all like the “Shining City on a Hill” that Ronald Reagan promoted. And while Reagan’s flowery language may have just been effective rhetoric, the world has seen the United States in that light for much of the last century. At the same time we are seeing the exhaustion of a decade long favorable trend for the United States, Donald Trump is making the U.S. a place less business friendly, and less safe for democracy. Erratic policy not guided by any basic principles is not conducive to companies relocating to the U.S.

Waiting Game

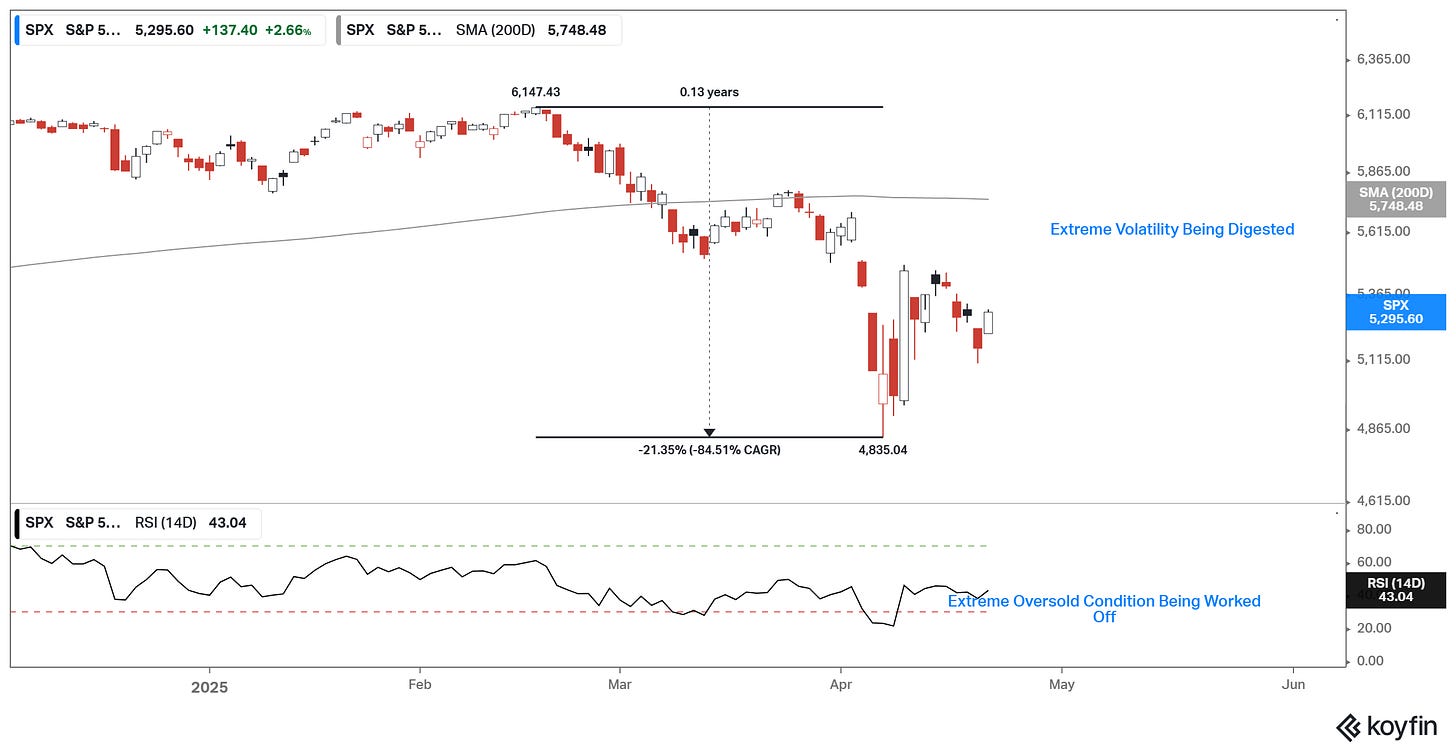

Markets have stabilized over the last couple of weeks after close to record volatility (VIX at 55). Chart 4 shows recent SPX price action. Trump’s “reciprocal” tariffs had implemented a few weeks ago had the world economy staring into the abyss, but the respite from that, with only 10% tariffs for 90 days, has brought us back from the brink. With the RSI having hit 20, and the SPX down around -20%, it’s typical to see the market take any good news to find a bottom. Minus any other unforeseen events (shockingly bad data etc.) the market will probably hold these levels for a month or so, while investors pray that the trade war comes to a quick close. In the meantime, everyone is on tweet alert. On any given day, Donald Trump may make a statement, or send a tweet that could cause the market to crater, or to scream higher. The biggest danger in the world right now happens to be the “Leader of the Free World”, and that’s a cause of uncertainty that isn’t going away anytime soon.

Disclaimer:

The information provided in this newsletter is for educational and informational purposes only and should not be considered as investment advice, a recommendation, or an offer to buy or sell any securities. The views expressed are based on personal opinions and analysis of market conditions, which are subject to change at any time without notice. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers are advised to conduct their own research or consult with a qualified financial advisor before making any investment decisions. The publisher is not responsible for any investment decisions made based on the information provided in this newsletter.